Sprint's latest financials show that while the network is slowly stemming the flow of cash from its veins, it's not quite there in terms of turning a profit. The country's third biggest carrier suffered a $767 million net loss and an operating loss of $231 million -- much less than the $629 million operating loss it had in Q2, but on-par with the $208 million lost in the same period last year. The business did manage to bring in total revenues of $8.8 billion, but had to take a hit on a $397 million write-down on costs related to Network Vision and the continued pain of the Nextel shutdown.

On the customer size, it added a further 900,000 users, sold 1.5 million iPhones and a further 1 million "LTE smartphones" in the quarter. Those with long memories will know that the company sold the same number of Apple handsets in the last two quarters, with around 40 percent going to new customers then as now. However, churn, the deadly enemy of all carriers, increased to 1.88 percent, up from 1.69 percent in Q2. The network did manage to coax 59 percent of former Nextel customers to stay tied up with Big Yellow, which may account for it selling nearly 1.2 million Direct Connect devices. While it's hardly a rosy estimation of Sprint's financial health, this report doesn't take into account Softbank's $20.1 billion buy-out or the regained controlling stake in Clearwire -- so we're expecting the next financial announcement to contain some more exciting news.

Update: During the conference call, Dan Hesse was asked about adopting a shared data plan to rival Verizon and AT&T, but unlike the last call, he was dismissive of the idea.

Filed under: Cellphones, Mobile

Sprint sells 1.5 million iPhones, 1 million other smartphones, but makes a net loss of $767 million originally appeared on Engadget on Thu, 25 Oct 2012 07:05:00 EDT. Please see our terms for use of feeds.

Permalink |

Sprint (PDF)

Sprint (PDF) |

Email this |

Comments

LG hasn't made a profit from its smartphone division for years, but it reckons the tide is about to turn. Speaking at a press conference at CES, the company's chief executive Kwon Bong-seok said, "LG Electronics mobile business is going to be profita...

LG hasn't made a profit from its smartphone division for years, but it reckons the tide is about to turn. Speaking at a press conference at CES, the company's chief executive Kwon Bong-seok said, "LG Electronics mobile business is going to be profita...

LG hasn't made a profit from its smartphone division for years, but it reckons the tide is about to turn. Speaking at a press conference at CES, the company's chief executive Kwon Bong-seok said, "LG Electronics mobile business is going to be profita...

LG hasn't made a profit from its smartphone division for years, but it reckons the tide is about to turn. Speaking at a press conference at CES, the company's chief executive Kwon Bong-seok said, "LG Electronics mobile business is going to be profita...

Both of South Korea's electronics giants have announced fourth quarter results that were less than ideal. Within hours of Samsung posting a double-digit reduction in quarterly profit, LG has revealed that it lost 80.7 billion Korean won ($72.5 millio...

Both of South Korea's electronics giants have announced fourth quarter results that were less than ideal. Within hours of Samsung posting a double-digit reduction in quarterly profit, LG has revealed that it lost 80.7 billion Korean won ($72.5 millio...

Back when MoviePass first announced its $10-a-month subscription for one movie a day, AMC said the scheme was like "turning lead into gold." Since no alchemist stepped forward to do that for MoviePass, the movie ticketing service's parent company, He...

Back when MoviePass first announced its $10-a-month subscription for one movie a day, AMC said the scheme was like "turning lead into gold." Since no alchemist stepped forward to do that for MoviePass, the movie ticketing service's parent company, He...

It's a testament to how topsy-turvy the mobile world is that a company can make its seventh successive quarterly loss and still feel good. That's because LG's mobile division, which managed to burn almost 500 billion Korean won in the last three mont...

It's a testament to how topsy-turvy the mobile world is that a company can make its seventh successive quarterly loss and still feel good. That's because LG's mobile division, which managed to burn almost 500 billion Korean won in the last three mont...

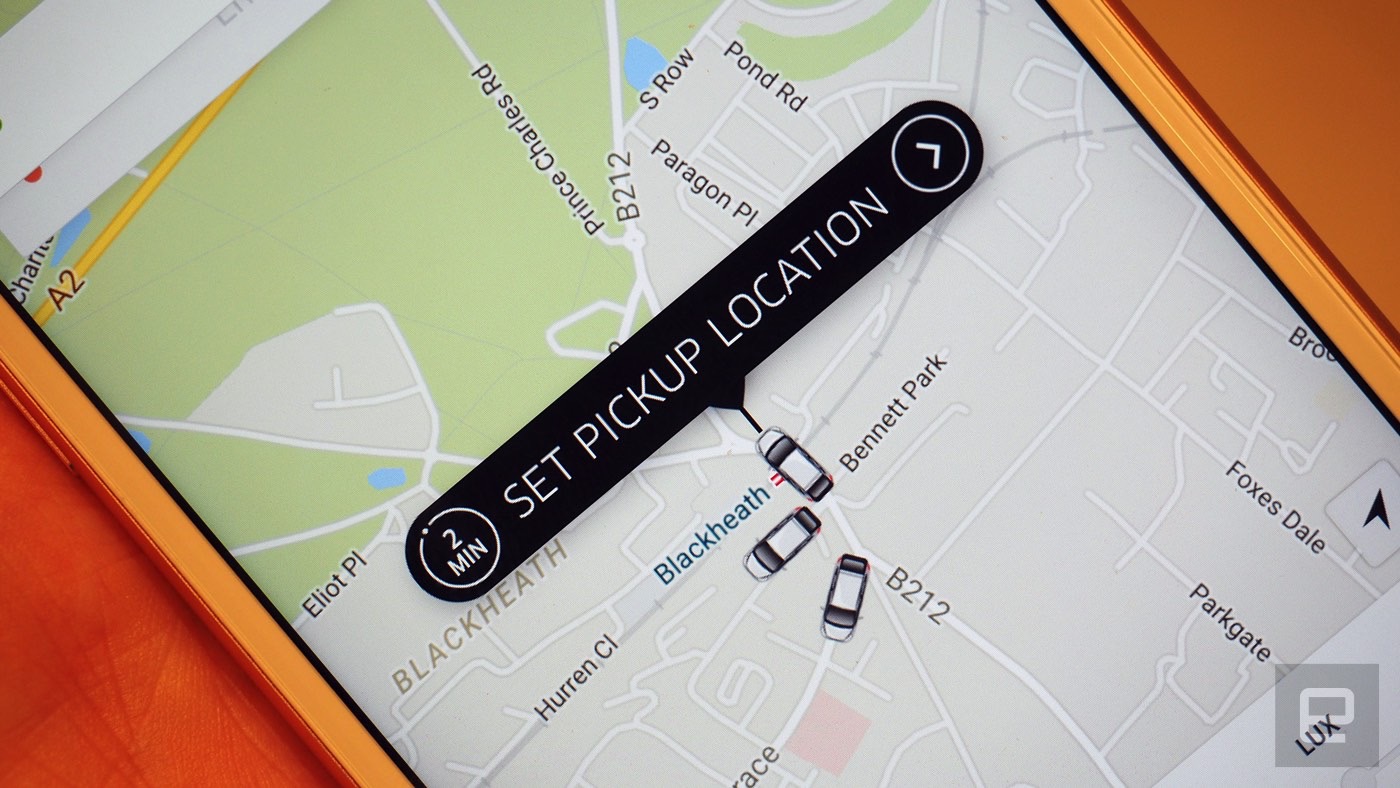

Uber is a fairly well-established business at this point, so you'd be forgiven for thinking that it makes a profit at this point. But today Uber held a conference call with investors and revealed that it is losing a ton of money so far this year. Acc...

Uber is a fairly well-established business at this point, so you'd be forgiven for thinking that it makes a profit at this point. But today Uber held a conference call with investors and revealed that it is losing a ton of money so far this year. Acc...